This week in the Wall Street Journal, Jack Nicas writes about admission tickets to the Indianapolis Zoo ranging in price from $8 to $30 per person based on advance sales and expected demand. Like airlines and hotels, more and more businesses are varying their prices by the day, hour, or even minute. Other than happy hours and discounted matinees, most low-priced products and services historically were set at fixed prices with changes being barely noticeable and occurring infrequently.

Technology now allows rapid price changes to commonplace purchases such as transportation (consider peak pricing offered by Uber and Lyft), toll roads (a six-mile stretch of I-820 near Dallas ranges from $0.91 to $4.48), ski tickets ($9.99 to $31.99 at Swiss Valley), and even big box stores (Kohl’s uses electronic price tags to change prices remotely as frequently as every few hours). Professional sports and theme parks are also implementing, or at least studying, variable pricing based on factors such as the weather, the day of the week, school holidays, remaining capacity, and (in the case of sports) the opposing team.

The Wall Street Journal’s Nicas cites Peter Fader, co-director of the University of Pennsylvania’s customer-analytics initiative, who says “This is not a passing fad,” and that customers typically resist dynamic pricing when it is introduced, but then quickly acclimate “with a remarkable lack of backlash.”

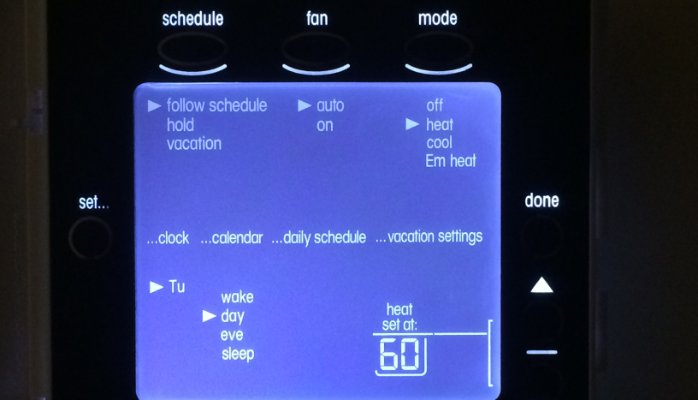

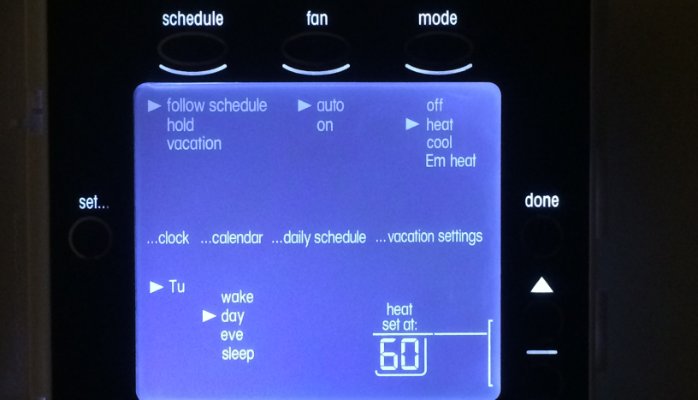

Residential electricity prices have historically been set at a flat 24/7 price, despite “[p]rice [being] the ‘central nervous system of the economy,'” as confirmed by the Supreme Court. In 2007, the Electric Energy Market Competition Task Forcestated that “[p]rice changes signal to customers in wholesale and retail markets that they should change their decisions about how much and when to consume electric power.” True, there have been certain regional exceptions for time-of-use pricing and, more recently, demand response based on real-time wholesale prices, but for the most part such programs have been relatively unrefined compared to today’s capabilities.

Now, though, with smart meters becoming increasingly prevalent, along with powerful and affordable data-crunching capabilities, utilities and energy services companies have powerful and accurate tools to shape load by sending price signals that reflect the real-time state of the grid. These price signals will, in turn, drive usage in a way that addresses the widely acknowledged disconnect between wholesale and retail energy markets and result in the efficient utilization of resources and deployment of capital.

I invite you to follow or connect with me on LinkedIn at https://www.linkedin.com/in/michaelkrauthamer, Twitter (@mkrauthamer), and my website at www.krauthamer.com.