Real-time and day-ahead wholesale energy prices in PJM Interconnection, the regional grid operator serving 60+ million customers in 13 states and the District of Columbia, fell by more than a third in the first half of 2016 compared to the first half of 2015 according to a recent report from Monitoring Analytics, the grid operator’s independent market monitor.

The decline is attributed to lower fuel prices and lower demand for electricity. Specifically, the load-weighted average real-time locational marginal price* (LMP) was 36.0 percent lower in the first six months of 2016 than in the first six months of 2015. In terms of dollars per MW-hour (the cost of generating one megawatt of power for one hour), this means a decline from $42.30 to $27.09. Day-ahead prices declined by a similar amount, 36.8 percent, from $43.26 per MW-hour to $27.33 per MW-hour.

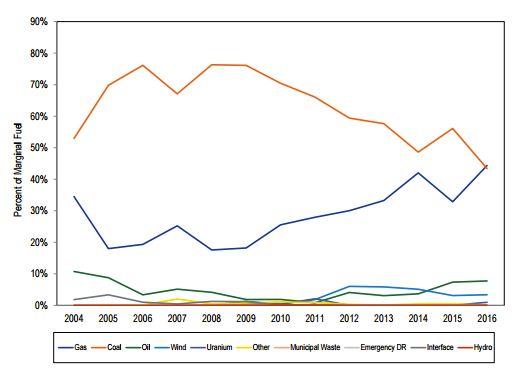

The first factor driving price, which is fuel, reflects a decline in the coal and gas commodity markets. The other factor driving LMPs down was reduced demand. Average load in the first half of 2016 was 5.3% lower than in the first half of 2015 (90,586 MW vs. 85,800 MW), and average offered real-time generation increased by 458 MW, from 156,679 MW to 157,137 MW.

While notable, this price drop will generally not be seen quickly by most residential retail customers for the following reasons:

- The price of energy is only part of the total bill that residential customers pay. The balance of the bill includes distribution charges (the utility’s cost of maintaining the local grid) and various taxes and fees.

- In addition to energy being only a portion of the bill, energy itself is comprised of multiple factors, LMP being only one. According to the market monitor’s recent report, LMP today is about two-thirds of the energy cost (the other third being capacity, transmission, and a few incidental energy-related services).

- Residential retail electricity prices, as well as most retail electricity prices in general, are usually set relatively far in advance and adjust slowly and periodically.

That said, the real-time prices addressed by Monitoring Analytics are a key signal for short, medium, and long-term contracts. Therefore, if low LMPs are sustained, as appears to be the case today, then these prices will eventually make their way into the prices all customers pay.

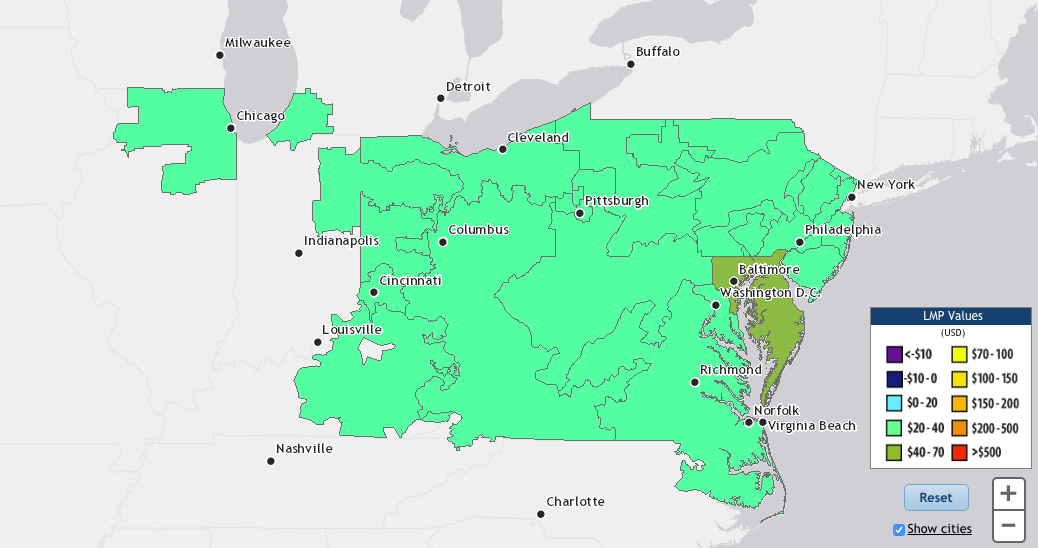

*LMP is defined as “the hourly integrated market clearing marginal price for energy at the location the energy is delivered or received.” The market for electricity on the PJM grid contains many delivery points (see map above), and the price at any given point is determined largely by the cost of the most expensive generator delivering electricity to that point at that particular time.

I invite you to view my other posts and sign up to receive future posts via email. I also invite you to follow me on LinkedIn and Twitter, and to contact me via my homepage.