Audi to Introduce Solar Roofs, Improve Fuel Efficiency and EV Range

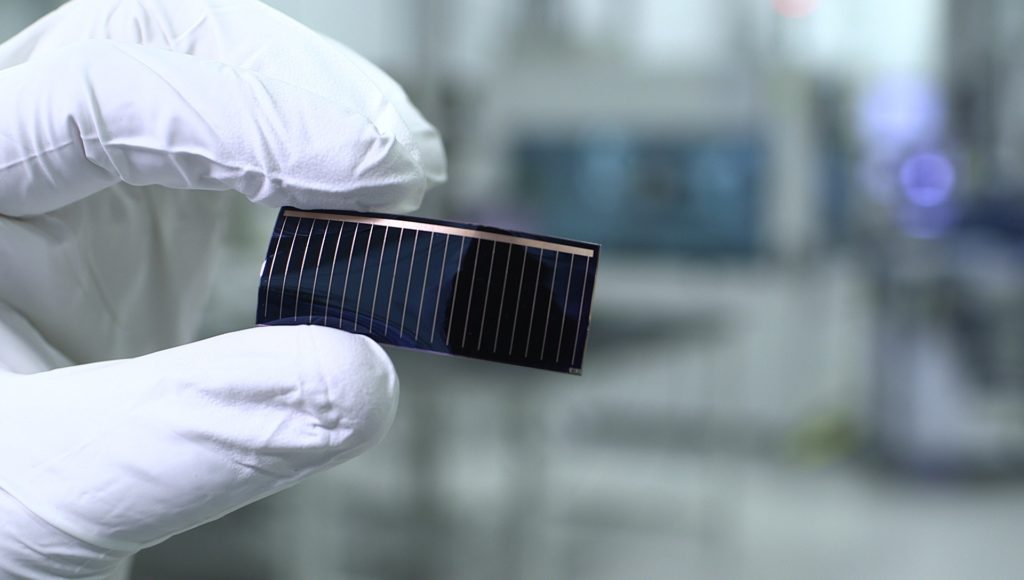

Audi today announced a plan to increase the range of the company’s electric vehicles by generating onboard solar energy using thin-film solar cells. Audi and its partner, California-based Alta Devices, a subsidiary of the Chinese solar-cell specialist Hanergy, are taking an incremental approach and will first integrate Alta’s efficient, thin, […]

Audi to Introduce Solar Roofs, Improve Fuel Efficiency and EV Range Read More »